We got good news for technology companies large and small on this fine Wednesday morning: valuations are rising, albeit at a modest pace.

New public market data indicates that software stocks have risen to their all-time highs this year. And to sweeten things up, underlying revenue multiples in publicly traded companies are also increasing, especially in the faster-growing subset of software companies.

The Exchange examines startups, markets and money.

Read it every morning on businessroundups.org+ or get The Exchange’s newsletter every Saturday.

Investors today seem to think that public software companies are worth more per dollar of revenue overall. That will take some pressure off of startups struggling to raise new capital at attractive prices or harmonize legacy private market valuations with their hoped-for IPOs. Clearing the massive liquidity backlog at startup will take more than a modest re-inflation of software valuations, but it’s a start.

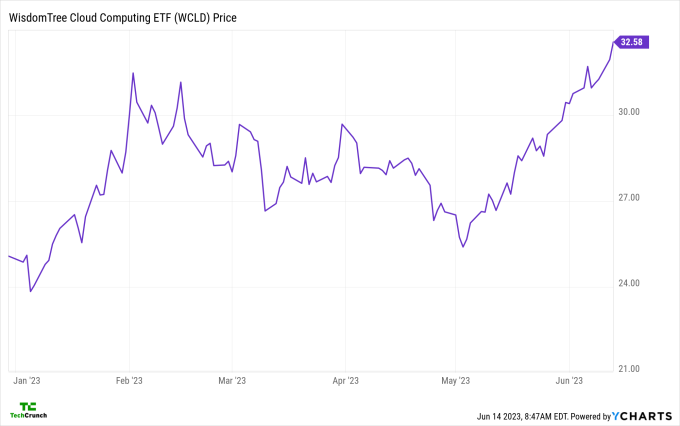

Starting with high-level numbers, here’s a look at the Bessemer Cloud Index performance this year. Note that the value of the constituent companies started the year strong, returning most of those gains and starting to pick up steam from May (YCharts data):