Stepthe digital banking service aimed at teens and young adults now offers a 5% rate on its savings accounts.

With only 1 in 3 Americans have enough savings for emergenciesStep is one of dozens of startups, such as Current, Greenlight, Super.com and Hyve, that focus on helping people save.

There are no monthly fees and no minimum balance requirements for the Step accounts and customers who open an FDIC-insured savings account with up to $250,000. However, to secure that 5%, users must make a monthly direct deposit of $500 or more with a payroll provider or employer.

“The direct deposit is to encourage people to use the full line of Step products,” CJ MacDonald, Step co-founder and CEO, told businessroundups.org.

And to be clear, “the savings rate is not interest, but is instead earned as cash rewards funded and administered directly by Step,” the company said.

Speaking of rewards, also new is Step’s increased rewards program. Customers who qualify for the 5% on their savings also earn 3x points on purchases from selected merchants; 2x points for restaurant dining, food delivery, and charitable donations; and 1x points on entertainment, streaming and gaming.

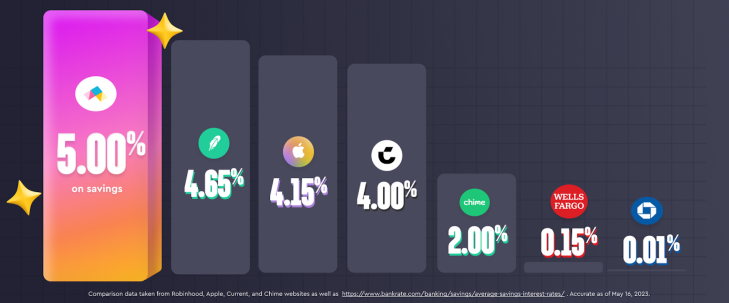

The news comes about a month after Apple launched its 4.15% savings account balance. When that announcement was made, actual data from Bank rate showed savings accounts APY rate from 3.5% to 4.75%. As of May 17, the APY range is 4% to 4.85%, so it’s safe to assume that Apple’s entry into the market may have inspired neobanks and other financial organizations to close the gap.

Step had always aimed to offer the highest percentage of competitors to attract customers and grow with it, so Apple’s move did not inspire it to launch the high savings rate, MacDonald said.

“The hard thing about interest rates is that they keep changing,” MacDonald said. “The rates have gone up in the past year and a half. Every time they go up, the [Federal Reserve] Fed Fund Rates going up, and for every institution that is paid, interest rates go up as well. If they continue to rise, the 5% could go even higher. Based on current rates, it’s important to essentially give clients back what the Fed Fund rates are.

Step is working on the savings accounts with her old banking partner Evolve Bank & Trust. Meanwhile, the company, which has raised more than $500 million in risk-backed funding — most recently last October — has more than 4 million account holders.