Want more fintech news in your inbox? To register here.

Fintech startup Plaid started out as a company that connects consumer bank accounts to financial applications, but has since gradually expanded its offerings to provide more of a full-stack onboarding experience.

And today, Plaid is announcing even more new product releases that take the company in an entirely new direction while helping to diversify its revenue streams.

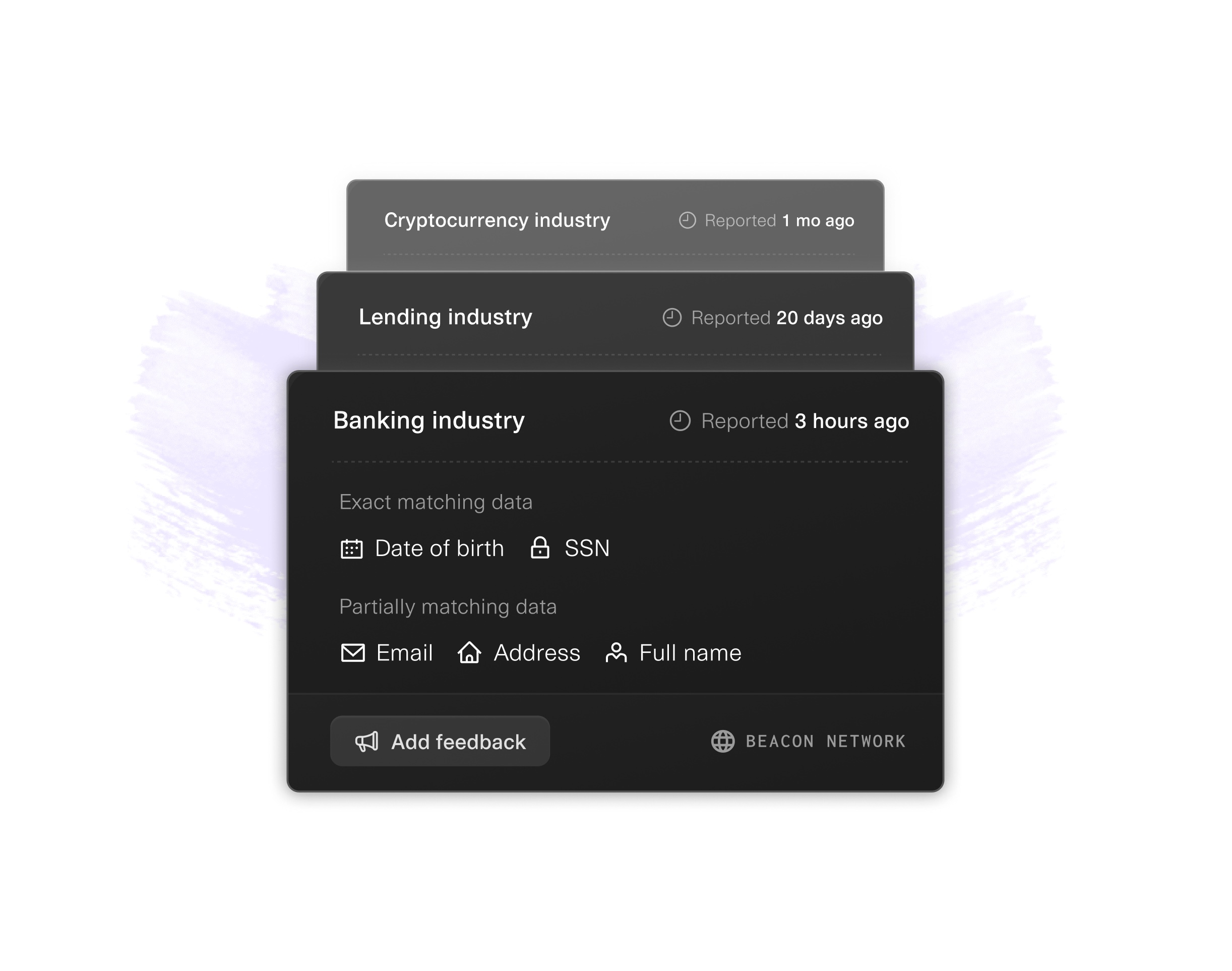

At the top is Beacon, which it describes as a “collaborative anti-fraud network that enables financial institutions and fintech companies to share critical fraud information via API in Plaid.”

Plaid launches Beacon today with 10 founding members including Tally, Credit Genie, Veridian Credit Union and Promise Finance. The argument for the need for such a network is that banks today already have access to shared fraud intelligence networks, but most companies don’t have access to the same types of tools.

“The idea behind Beacon is that the vast majority of fraud that one fintech sees has been seen before by another fintech,” Alain Meier, former CEO of Cognito and current head of identity at Plaid, told businessroundups.org in an interview. “So essentially that means everyone is rebuilding the same anti-fraud mechanisms to try and catch the exact same fraud many times, which means a lot of money and time is wasted.”

Beacon represents Plaid’s efforts to give fintechs a way to report fraud cases to each other. Participating members of the network will contribute by reporting instances of fraud, including stolen, synthetic, and account takeovers, to Plaid. From there, they can then screen new logins or users on the Beacon network to detect if a specific identity has been associated with fraud on other Plaid-powered platforms or already within their own organization. For example, a fintech might share that a particular stolen identity was just used to sign up for one of their accounts. When that same stolen identity is used to sign up for another fintech, the company can “look closely at the transaction and protect the company and consumers associated with that identity,” Meier said.

Image Credits: Plaid

Beacon is now available to fintechs and financial institutions of all sizes and to Plaid’s more than 8,000 customers. A company pays Plaid to join the network.

According to Meier, the purpose of the new offer is twofold.

‘One, that’s it to help the companies more efficiently and accurately detect fraud going on in their systems and prevent a chain reaction of switching between different fintechs,” he said. “And secondly, we also want to give consumers a mechanism to protect their identity.”

It’s also important, according to Plaid, given that regulators are scrutinizing fintechs more closely, trying to make sure they “adhere to the same levels of security and compliance that the banks have had for many years.”

Plaid spent about a year building the product, which Meier acknowledged was “a really hard product to launch”.

When it comes to limiting his deductible, Plaid says yes exploit the network for the same purpose of securing sensitive information in the same way as securing financial account data. Beacon, it says, does not share any personally identifiable information back to participating companies, beyond whether the identity information they screen has been linked to fraud on other platforms. The company also emphasizes that it is not used for decision-making, noting that “what Beacon does is provide customers with an extra layer of fraud intelligence that customers can then use to perform verifications or other security checks.”

The company also announced a new feature last week called Remember Me, which allows a user who has completed identity verification to log in and remember their identity the next time they are prompted to authenticate.

In January 2022 it is acquired Cognito, which provided identity verification and assistance with issues such as knowing your customer (KYC) rules and anti-money laundering requirements, for $250 million. The company then moved on to offerings related to what it called “onboarding optimization” and risk and fraud mitigation.

Plaid has also made a push on the payments side, with products like Transfer and Signal, which enable the movement of money and the evaluation of the risk of moving money, respectively. (It now claims to analyze more than $2 billion in transactions each month).

“We’ve had really good success with very high sign-up rates for our new products, so we now feel good about our multi-product strategy,” said Meier.

Do you have a news tip or insider information about a topic we covered? We’d love to hear from you. You can reach me at maryann@businessroundups.org.com. Or you can send us a message at tips@businessroundups.org.com. Please respect anonymity requests.