Apologies to John Lennon and the Plastic Ono Band for the title of the article on VXN and QQQ puts.

The recent red-hot rally in stocks, especially the NASDAQ 100 names, has charged the bulls again and put the bears into hibernation. Whether the momentum will continue or not is certainly uncertain.

One thing is certain, though, some inventory measures are definitely getting more extreme, warranting caution. Protecting or playing for a possible disadvantage is something to think about seriously.

Rather than simply exiting or shorting stocks, using options strategies makes more sense in the current environment.

Here are three key reasons why now could be a good time to buy bearish puts, either for portfolio protection or short-term speculative trading.

implied volatility

Most of you are probably familiar with the VIX, also known as the fear meter. It is a measure of option prices in the S&P 500. How many of you know that the NASDAQ 100 has a similar tool for measuring implied volatility -VXN- or “Vixen”. Below is the Chicago Board Options Exchange (CBOE) definition for the VXN. For our purposes, we replace QQQ with NDX, as QQQ is much more heavily traded.

The Cboe NASDAQ-100 volatility indexSM (VXN) is a key measure of market expectations of near-term volatility conveyed by NASDAQ-100® Index (NDX) option prices. It measures the market’s expectation of 30-day volatility implicit in the prices of NASDAQ-100 options in the near term. VXN is quoted in percentage points.

The VIX has fallen sharply lately as stocks have risen over the past month. VIX closed just above year-to-year lows on Friday as the S&P 500 rallied, albeit well off its yearly highs.

However, VXN closed at a new annual low on Friday as the NASDAQ 100 (QQQ) closed at a new annual high. Also, VXN closed at its lowest level since January 2022.

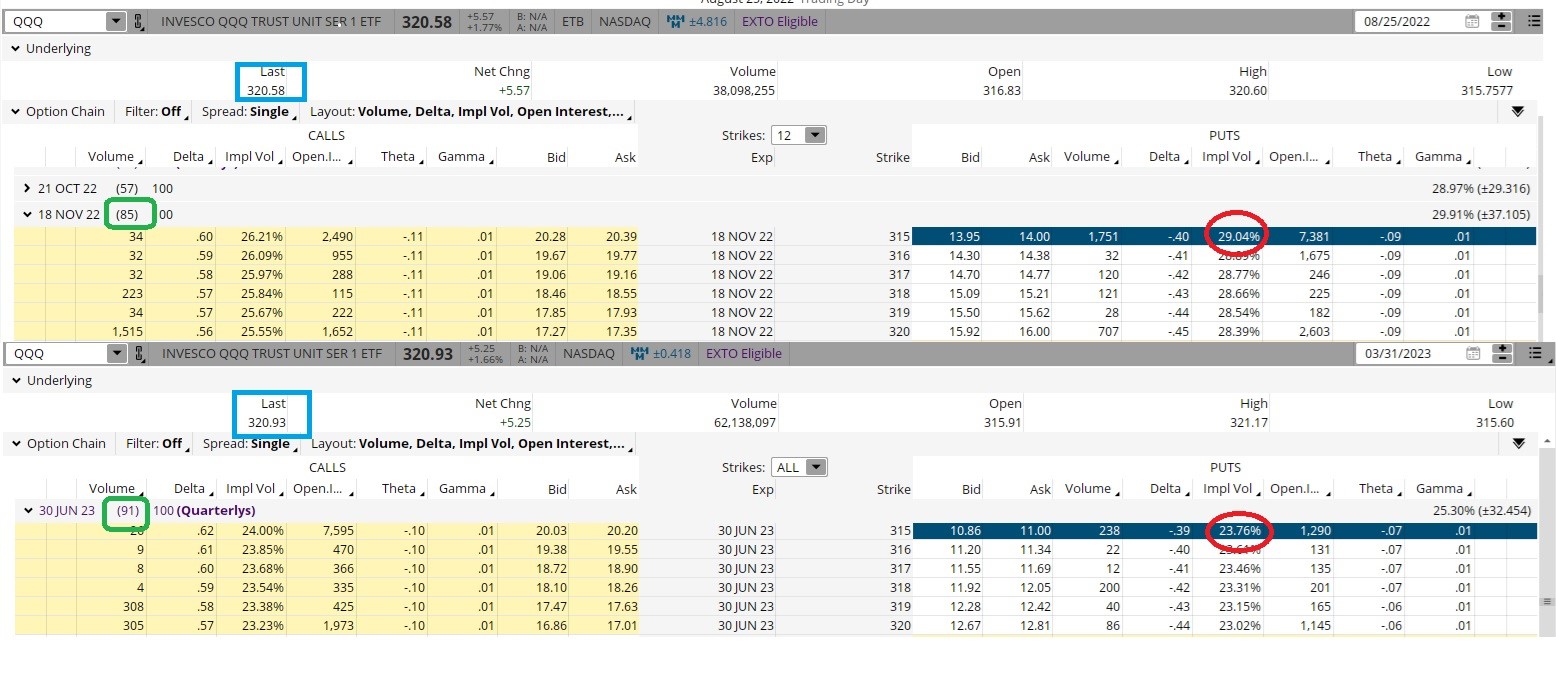

A quick comparison of the last time QQQ had a similar price will show how much the drop in VXN lowers the price of puts. The comparative option mounts are shown below.

On August 25 last year, QQQ closed at $320.58. The 18 Nove $315 puts had 85 days to expiration and were priced at $14.00. IV was just over 29.

Fast forward to Friday and QQQ closed at $320.93, so only 38 cents higher than in August. The $315 expiration on June 30 had 91 days to expiration, so a few days longer than the comparable November 18e expiration date sets back to August. The 30 Junee puts were priced at $11.00. IV was just short of 24.

All told, last August’s slightly underperforming $315 puts traded $3.00 cheaper than the near-similar puts trading now.

Another way to look at it, the puts in August cost 4.37% of QQQ’s price compared to just 3.43% now. All because IV dropped from 29.04 to 23.76. To me, buying wells at a much lower price (and the cheapest price in a long time) is never a bad thing.

VXN is also a reliable market timing tool, in that respect it is very similar to the VIX. Drops to relatively low levels of VXN almost always coincide with short-term highs in QQQ, as the chart below shows. Is the QQQ near a top$ The VXN implies that.

Technical data

The NASDAQ 100 (QQQ) is technically overbought. 9-day RSI is now over 70. Bollinger Percentage B just passed 100. MACD reached an extreme level. Stocks trade at a high premium to the 20-day moving average. The last time these indicators all aligned in a similar fashion, they marked a short-term top in QQQ.

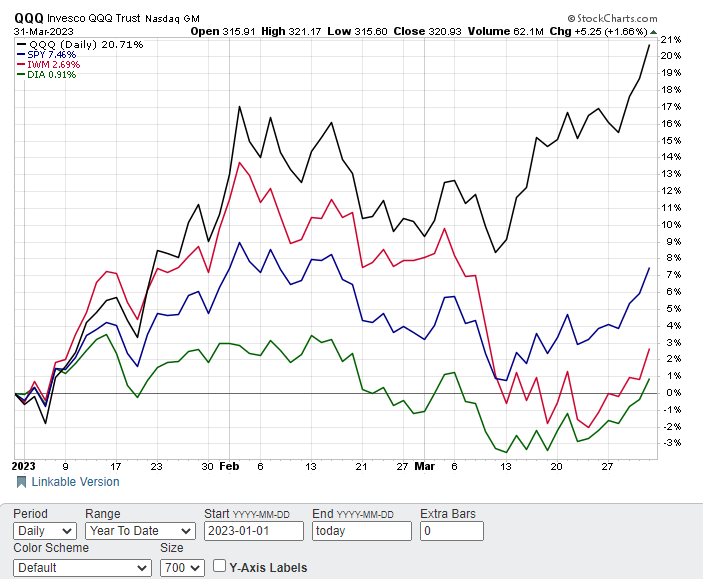

NASDAQ 100 (QQQ) is a bit above the skis on a comparative basis compared to the other three major indices. The Nazzy is showing a spectacular gain of more than 20% so far in 2023. Compare that to the still very respectable gain of almost 7.5% for the S&P 500 (SPY) and it’s easy to see how much QQQ has risen relative to other stocks in Q1. If you compare QQQ’s earnings to those of either IWM (Russell 2000) or DIA (Dow Jones Industrials), the outperformance is even more astonishing.

Some outperformance of the NASDAQ 100 is certainly warranted as it was the worst performing index of the big four in 2022. However, that outperformance is now becoming extreme. Expect QQQ to be an underperformer in the coming months as the relative spread converges back to the more traditional relationship.

Fundamentals

Two stocks, Microsoft (MSFT) and Apple (AAPL), account for more than 25% of the NASDAQ 100 Index weighting. They also include more than 13% of the S&P 500-the first time two stocks were so powerful since IBM and AT&T in the late 1970s. In addition, they are the only stocks with a market cap of more than $2 trillion.

As these two stocks go, so too, in large part, is the NASDAQ 100 and stocks in general. Looking at the valuations of these two mega-cap names gives us a good insight into valuations in general for QQQ.

The price-to-sales ratio for Microsoft (MSFT) with the highest weighting is now well above 10 again and at its highest multiple since August 2022, when QQQ peaked.

Number two Apple paints a similar picture.

The price-to-earnings ratio in MSFT is even more extreme, now at a higher level than the previous QQQ price spike. All this even with interest rates rising sharply in that time frame, which should cause multiples to shrink.

Option prices are cheap. The NASDAQ 100 is technically overbought and fundamentally overvalued. Combining these two statements together makes buying puts now on QQQ much cheaper and much more sensible than ever this year. All we need is for the market to return to some semblance of sensitivity to profit from a put play.

POWR options

What to do now?

If you’re looking for the best options trading for the current market, check out our latest presentation How to trade options with the POWR ratings. Here we show you how to consistently find the best option trades while minimizing risk.

If that appeals to you and you want to learn more about this powerful new options strategy, click below to access this current investment presentation now:

How to trade options with the POWR ratings

All the best!

Tim Biggam

Editor, POWR Options Newsletter

QQQ shares closed Friday at $320.93, up $5.25 (+1.66%). Year-to-date, QQQ has gained 20.71%, versus an increase of 7.46% in the benchmark S&P 500 index over the same period.

About the author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His main passion is to make the complex world of options more understandable and therefore more useful for the everyday trader. Tim is the editor of the POWR options newsletter. Read more about Tim’s background, along with links to his most recent articles.

The mail Three Valid Reasons to Say “Give Puts a Chance” appeared first on StockNews.com