Managing pairs trading the POWR Options way is likely to succeed in increasing the chances of winning.

We have discussed the benefits of a pairs trading approach in several previous articles. A pairs trade is simply taking a bullish position on the stock you believe will outperform a comparable stock on which you take a bearish position. Buy Ford/Sell General Motors the classic example if you think Ford will outperform GM.

In many ways, instead of using simple stocks to express the views, it is better to use options. Why? Reduced risk, lower initial costs and three slightly lesser known, but very important benefits.

A quick walk through our recent trading of the POWR Options portfolio will shed some light on understanding these “under the radar” trade management benefits we use.

The pairs trade we selected was a recently completed bullish call on Cheniere Energy Partners (CQP) and a bearish put on Sunoco (SUN). Both oil-related names are so highly correlated with stocks, meaning they regularly move up and down together.

First trade February 27 shown below:

Take action

Buy to open SUN 6/16/2023 $50 put at $4.10 with discretion of 0.20

Each choice costs about $410 per contract.

Take action

Buy to open CQP 6/16/2023 $50 call for $4.00 with 0.20 discretion

Each choice costs about $400 per contract.

The reasoning on the trade was as follows: Cheniere Energy Partners (CQP) was an A-rated (Strong Buy) stock, while Sunoco (SUN) was a C-rated (Neutral) stock. Both in the same industry: MLP Oil & Gas.

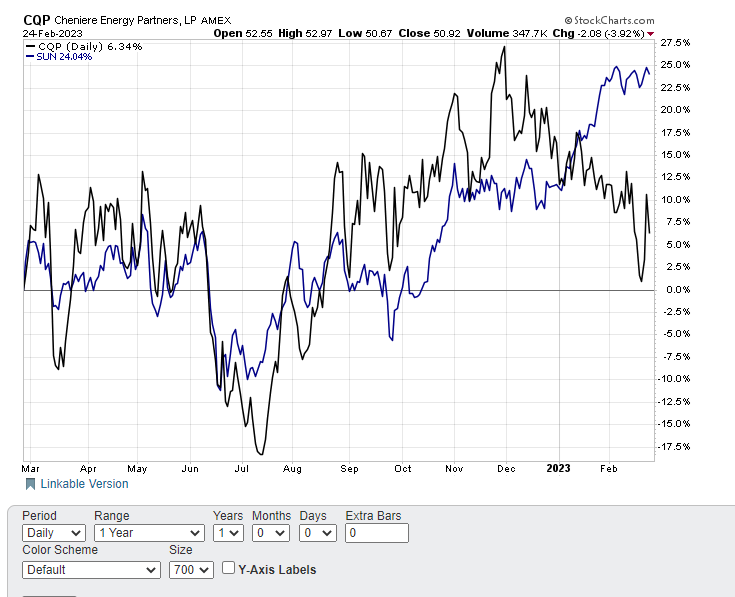

You would expect these two stocks to move in a similar fashion as they are both oil related names. Indeed, they did almost all of 2022.

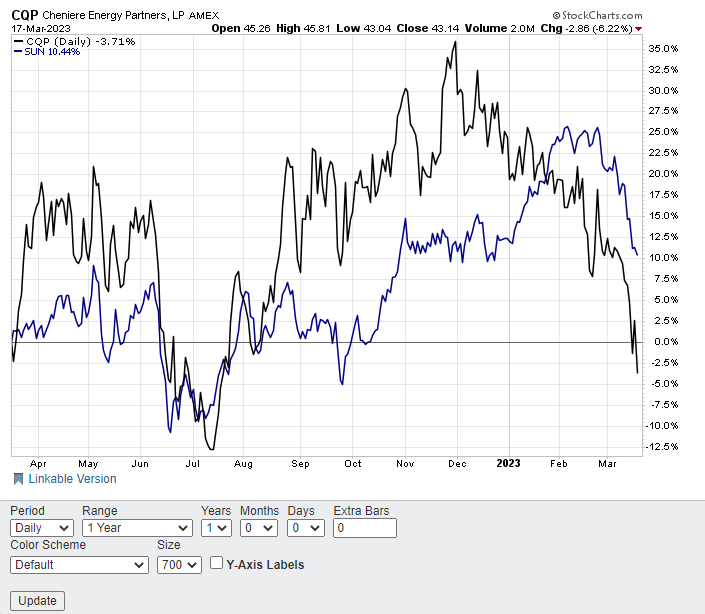

However, the much lower-rated SUN dramatically outperformed the higher-rated CQP by more than 17% in 2023. The chart below shows how these two normally related stocks fared apart. Trading in pairs was initiated with the expectation that CQP would then outperform SUN in subsequent weeks and that the spread would narrow. This outperformance would cause the spread to converge, leading to a profit.

This did happen, but not to a large extent. The spread did converge by about 3.5%, narrowing from 17.7% to 14.15% as both stocks fell sharply.

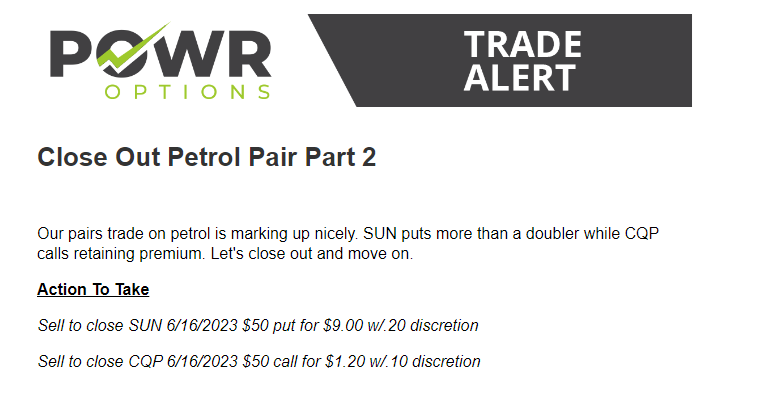

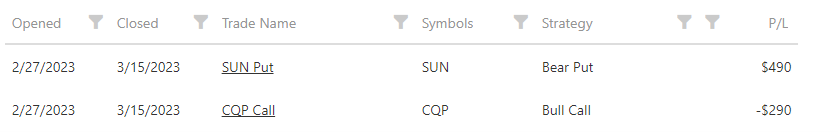

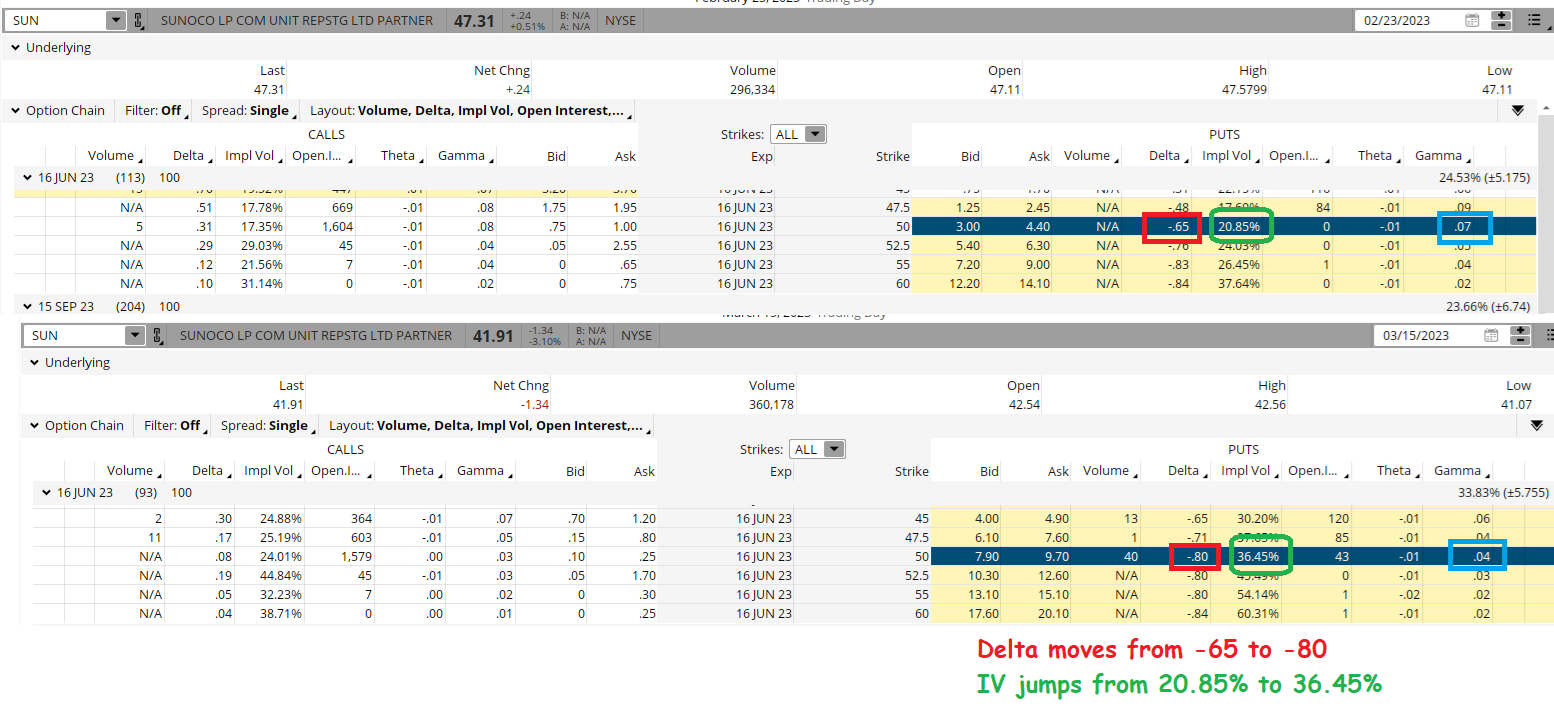

However, our pairs trade did quite well. Closed March 15, as seen below.

We gained $490 on the SUN puts and lost only $290 on the CQP calls for a net profit of $200 as shown in the table.

The initial pairs trading fee was $810. The net profit of $200 equates to a return of 24.69%. The retention period was just over two weeks. In addition, we were hedged with a bullish call and a bearish put on two highly correlated stocks at the start of trading.

So even though the two stocks that made up the pair trading started to converge as expected, that convergence certainly wasn’t responsible for most of the gains.

Instead, the three things listed below – gamma, time-lapse management, and implied volatility analysis – are the hidden benefits of the POWR option pairs trading approach.

gamma

Options move in a curved, non-linear fashion. The greater the favorable movement in the underlying stock, the more favorable the option moves in comparison. Conversely, the bigger the unfavorable move in the stock, the less the options will work against you.

The initial delta at the start of trading will change as the stock price changes. This rate of change in the option delta relative to the stock price is called “gamma.”

Gamma is an options metric that describes the rate of change in an option’s delta per one point move in the price of the underlying asset. Delta is how much the premium (price) of an option will change with a one point movement in the price of the underlying asset.

Buying options puts you on a long range. This means that you are more right if you choose the right direction. It also means you’re less wrong if you get the direction wrong. Sounds too good to be true? Well, it is, because time decay is the bad part of buying options.

Time lapse

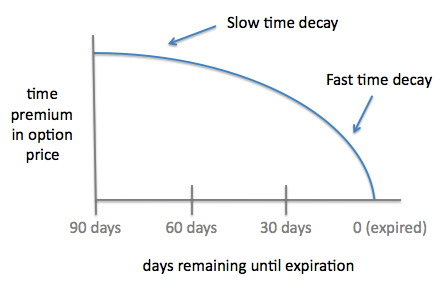

Options are a wasteful asset. Each day that passes, they lose a little more of their total value. This understanding is called time decay, or theta to use the Greek term. While gamma is the good side of options buying, theta is undoubtedly the bad side. POWR Options is well aware of time decay. This is why we almost always choose to close out the options well before their expiration (usually about 30 days).

The illustration below shows how option time expiration really hits hard in the last 30 days or so before the option expires. Getting out before then and salvaging the time premium or remaining value of the option is critical to long-term success.

Certainly exiting the CQP/SUN pairs trade in just a few weeks made the time lapse less relevant.

Having options you bought expire worthless, or for no value, is something that should be avoided at all costs. That’s what we’ve achieved in powr options so far.

implied volatility

At POWR Options, we always look very closely at Implied Volatility (IV) when considering trading opportunities. It is, in our opinion, one of the most crucial elements of options trading.

Implied volatility is a measure of how much the options market expects the underlying stock to move. Higher IV means larger moves are expected and lower IV corresponds to smaller expected moves. IV is also essentially the price of the option. Higher IV makes options more expensive. Lower IV makes options cheaper.

Since we always buy options, we focus on buying those options with relatively low implied volatility. Low comparative IV means option prices are somewhat cheap – always a good thing.

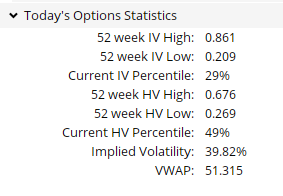

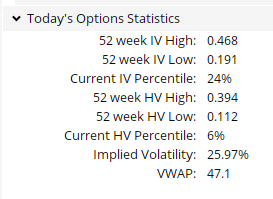

The current IV percentile is where the implied volatility is currently at compared to the IV range of the past year. The lower the percentile, the lower the IV is now. 100% would mean that IV has reached the highest values of the past year. 0% would be the lowest. 50% would be about average.

We try to buy options that trade well below the 50% level, in other words relatively cheap options. A look at the options on both SUN and CQP below shows that both were well below the 50% IV percentiles when we bought them on Feb. 27.

CQP IV

SUN IV

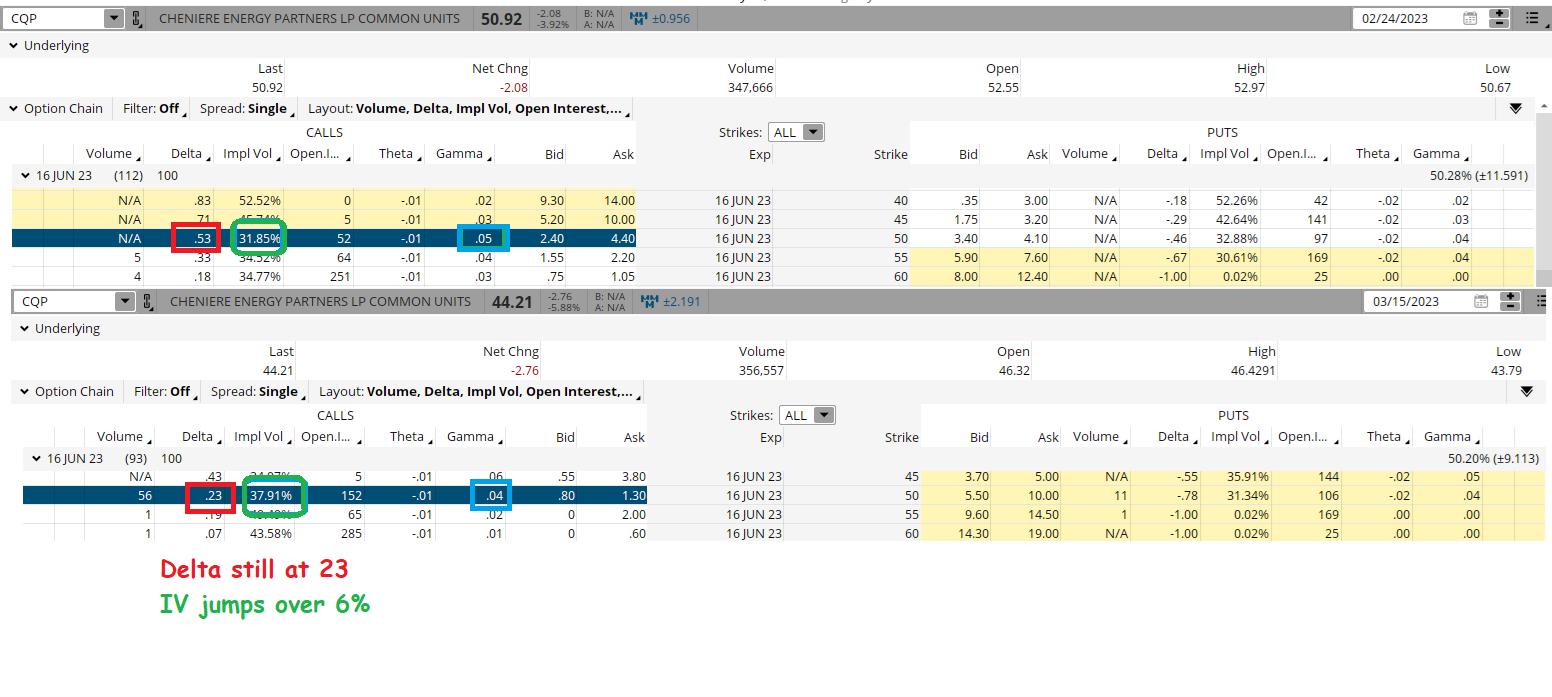

You can see below how the implied volatility (IV) increased from 20.85% when we bought the SUN puts to over 36% when we closed the position. Another advantage of buying cheaply priced or low IV options. It also shows how the delta on these bearish puts went from -65 to -80, the positive effect of gamma.

The same scenario also played out in the CQP calls.

The strength of the POWR ratings plus the expected convergence of related stocks can be a decided advantage when constructing pairs trades. Understanding the somewhat hidden benefits of gamma, time decay management and implied volatility analysis turns the pair trades into POWR pair trades. Turn the odds further in your favor with this approach.

POWR options

What to do now?

If you’re looking for the best options trading for the current market, check out our latest presentation How to trade options with the POWR ratings. Here we show you how to consistently find the best option trades while minimizing risk.

If that appeals to you and you want to learn more about this powerful new options strategy, click below to access this current investment presentation now:

How to trade options with the POWR ratings

All the best!

Tim Biggam

Editor, POWR Options Newsletter

SUN shares closed Friday at $41.60, down $0.32 (-0.76%). Year-to-date, SUN is down -1.79%, versus a 1.98% increase in the benchmark S&P 500 index over the same period.

About the author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His main passion is to make the complex world of options more understandable and therefore more useful for the everyday trader. Tim is the editor of the POWR options newsletter. Read more about Tim’s background, along with links to his most recent articles.

The mail Three better ways to turn odds in your favor with a POWR pairs approach appeared first on StockNews.com